Usage-Based Insurance Market Strategic Overview | Insights Into 2032

"Executive Summary:

"Executive Summary:

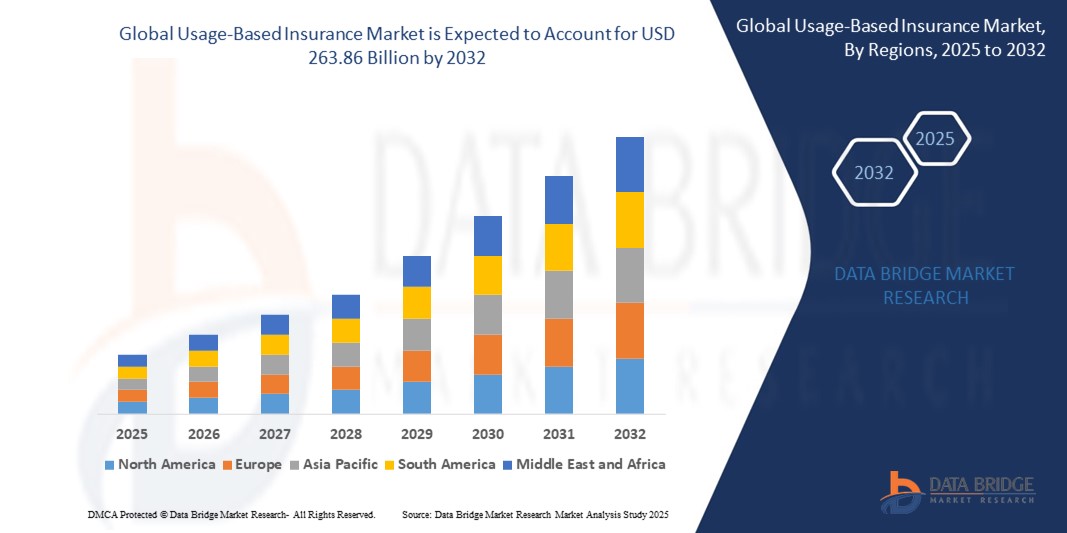

The global usage-based insurance market size was valued at USD 39.83 billion in 2024 and is expected to reach USD 263.86 billion by 2032, at a CAGR of 26.66% during the forecast period

New comprehensive research on the Usage-Based Insurance Market highlights promising growth prospects fueled by evolving consumer preferences and technological advancements. The latest market analysis projects a robust CAGR over the next five years, driven by increasing adoption across key sectors and expanding geographic reach. Market players are focusing on innovation and strategic partnerships to capitalize on emerging opportunities, positioning the Usage-Based Insurance Market as a critical component in the broader industry landscape.

The study further identifies key trends shaping the market dynamics, including the rise of sustainable solutions and digital transformation initiatives. Regional insights reveal strong growth potential in North America and Asia-Pacific, supported by favorable regulatory environments and infrastructure development. This in-depth report offers valuable data and actionable insights for stakeholders, enabling informed decision-making and strategic planning to navigate the competitive terrain of the Usage-Based Insurance Market.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Usage-Based Insurance Market report.

Download Full Report: https://www.databridgemarketresearch.com/reports/global-usage-based-insurance-market

Usage-Based Insurance Market Overview

**Segments**

- **By Package Type**: Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD)

- **By Vehicle Type**: Passenger Vehicle, Commercial Vehicle

- **By Device Offering**: OBD-II-Based UBI Programs, Smartphone-Based UBI Programs, Hybrid-Based UBI Programs, Black-Box-Based UBI Programs

The global usage-based insurance market is segmented based on package type, vehicle type, and device offering. In terms of package type, the market is categorized into Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD). PAYD programs calculate premiums based on the number of miles driven, PHYD programs consider driving behavior such as speed, acceleration, and braking, while MHYD programs assess both mileage and driving habits. By vehicle type, the market is divided into passenger vehicles and commercial vehicles. Additionally, based on device offering, the market includes OBD-II-Based UBI Programs, Smartphone-Based UBI Programs, Hybrid-Based UBI Programs, and Black-Box-Based UBI Programs. These segments offer insurers and consumers flexibility and customization in choosing the most suitable insurance options for their needs.

**Market Players**

- **Progressive Corporation**

- **Allstate Insurance Company**

- **Insure The Box Ltd**

- **State Farm Mutual Automobile Insurance Company**

- **Generali Group**

- **Metromile Insurance Company**

- **The Floow Limited**

- **Nationwide Mutual Insurance Company**

- **Aviva**

- **Desjardins Group**

[https://www.databridgemarketresearch.com/reports/global-usage-based-insurance-market ]The global usage-based insurance market continues to witness significant growth and innovation driven by the increasing adoption of telematics technology and the demand for personalized insurance solutions. Market players are focusing on offering diverse package types such as PAYD, PHYD, and MHYD to cater to varying customer preferences and driving behaviors. This segmentation allows insurers to tailor insurance premiums based on specific criteria, leading to more accurate risk assessment and pricing strategies. By segmenting the market based on package type, insurers can provide customized solutions that align with customers' driving habits and mileage usage, enhancing customer satisfaction and loyalty.

Furthermore, the segmentation of the market by vehicle type into passenger vehicles and commercial vehicles reflects the diverse needs of different customer segments. Insurers are developing specialized UBI programs tailored to the distinct requirements of passenger vehicle owners and commercial fleet operators. This segmentation enables insurers to offer targeted products and services that address the specific risk profiles and operational challenges associated with different vehicle types. By recognizing the unique characteristics of passenger and commercial vehicles, insurers can design UBI programs that deliver value-added benefits and cost-efficient insurance coverage to a wide range of customers.

The segmentation of the market based on device offering, including OBD-II-Based UBI Programs, Smartphone-Based UBI Programs, Hybrid-Based UBI Programs, and Black-Box-Based UBI Programs, highlights the technological advancements driving innovation in the usage-based insurance sector. Insurers are leveraging various monitoring devices and data collection methods to track driving behavior, collect vehicle data, and assess risk factors accurately. By offering multiple device options, insurers can accommodate different preferences and technological capabilities among customers, ensuring widespread adoption and participation in UBI programs.

In conclusion, the segmentation of the global usage-based insurance market based on package type, vehicle type, and device offering demonstrates the industry's commitment to personalized, data-driven insurance solutions. Market players are continuously evolving their UBI programs, collaborating with technology partners, and engaging with customers to enhance their competitiveness and service offerings in the insurance market. By understanding and leveraging these market segments effectively, insurers can navigate the complex landscape of usage-based insurance, meet changing customer expectations, and drive sustainable growth in the evolving insurance industry.The global usage-based insurance market segmentation based on package type, vehicle type, and device offering plays a crucial role in driving innovation and growth within the industry. The categorization of PAYD, PHYD, and MHYD programs allows insurers to tailor insurance premiums to individual driving behaviors, leading to more accurate risk assessment and pricing strategies. This customization leads to enhanced customer satisfaction and loyalty as insurers can offer personalized solutions that align with customers' preferences and habits.

Moreover, the segmentation by vehicle type into passenger vehicles and commercial vehicles enables insurers to develop specialized UBI programs that cater to the distinct needs of different customer segments. By recognizing the unique characteristics and risk profiles associated with passenger and commercial vehicles, insurers can offer targeted products and services that provide value-added benefits and cost-efficient coverage to a wide range of customers. This segmentation strategy ensures that insurers can address the specific operational challenges and requirements of each vehicle type effectively.

Furthermore, the segmentation based on device offering, such as OBD-II-Based UBI Programs, Smartphone-Based UBI Programs, Hybrid-Based UBI Programs, and Black-Box-Based UBI Programs, showcases the technological advancements driving innovation in the usage-based insurance sector. Insurers are leveraging diverse monitoring devices and data collection methods to track driving behavior accurately, collect vehicle data, and assess risk factors efficiently. By offering multiple device options, insurers can accommodate various technological preferences among customers, ensuring broader adoption and participation in UBI programs.

In conclusion, the segmentation of the global usage-based insurance market based on package type, vehicle type, and device offering underscores the industry's commitment to providing personalized, data-driven insurance solutions. Market players are continuously evolving their UBI programs, collaborating with technology partners, and engaging with customers to enhance their competitiveness and service offerings in the insurance market. By effectively leveraging these market segments, insurers can navigate the evolving landscape of usage-based insurance, meet changing customer expectations, and drive sustainable growth in the dynamic insurance industry.

The Usage-Based Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-usage-based-insurance-market/companies

Regional Outlook

North America:

The Usage-Based Insurance Market in North America is driven by advanced technological infrastructure, strong consumer demand, and supportive government policies. The United States holds the largest share due to early adoption and robust investment.

Europe:

Europe showcases steady growth in the Usage-Based Insurance Market, supported by strict regulatory frameworks, sustainability initiatives, and innovation-led economies. Key contributors include Germany, the U.K., and France.

Asia-Pacific:

Asia-Pacific is the fastest-growing region for the Usage-Based Insurance Market, fueled by population growth, urbanization, and industrial expansion. China, India, and Japan are major markets with high potential.

Latin America:

Growth in Latin America is moderate but rising, driven by expanding middle-class populations and increasing awareness of Usage-Based Insurance Market applications. Brazil and Mexico are the leading countries.

Middle East & Africa:

The Usage-Based Insurance Market in this region is gaining momentum due to infrastructural developments, diversification efforts, and rising investments. The UAE, Saudi Arabia, and South Africa are key players.

Competitive Landscape

Future Trends— Global Usage-Based Insurance Market

Upcoming Technologies:

The Usage-Based Insurance Market will witness rapid adoption of cutting-edge technologies such as artificial intelligence, machine learning, the Internet of Things (IoT), blockchain, and automation. These technologies are expected to enhance operational efficiency, enable real-time data-driven decisions, and introduce innovative products and services.

Consumer Behavior Changes:

The Usage-Based Insurance Market will be shaped by changes in consumer preferences toward offerings that are experience-driven, convenient, and personalized. Increasing demand for transparency, digital engagement, and value-driven purchases will push companies to innovate their marketing and product strategies.

Sustainability Trends:

Sustainability will be a critical focus, with consumers and regulators alike driving demand for eco-friendly materials, energy-efficient processes, and circular economy initiatives. Businesses are anticipated to prioritize green innovations to reduce carbon footprints and meet stricter environmental regulations.

Expected Innovations:

The market is expected to see significant innovations, including smart products, integration of advanced analytics for predictive insights, and development of new materials or solutions tailored to emerging needs. Collaboration between technology firms and industry leaders will accelerate these innovations.

Why This Report is Valuable

This report provides in-depth industry insights that help stakeholders understand the current market landscape, key drivers, challenges, and growth opportunities within the Usage-Based Insurance Market. It offers regional and segment-wise forecasts that enable precise market planning and targeted investment strategies tailored to specific geographic areas and product/service segments.

The report includes comprehensive competitor benchmarking, allowing businesses to evaluate their position relative to key players, understand competitive strategies, and identify gaps or opportunities for differentiation. Additionally, it delivers actionable strategic recommendations based on market trends and data analysis to support informed decision-making, optimize business growth, and enhance market presence.

Top 15 FAQs About the Global Usage-Based Insurance Market Research Report

- What key segments are analyzed in the Usage-Based Insurance Market report?

- Which regions show the highest growth potential in the Usage-Based Insurance Market ?

- What time frame does the Usage-Based Insurance Market report cover for forecasts?

- What are the major drivers influencing the growth of the Usage-Based Insurance Market?

- Who are the leading competitors in the Usage-Based Insurance Market?

- How is market size estimated for the Usage-Based Insurance Market?

- What research methodologies are used to compile the Usage-Based Insurance Market report?

- Does the report discuss regulatory impacts on the Usage-Based Insurance Market?

- Are emerging technologies covered in the Usage-Based Insurance Market analysis?

- How does consumer behavior affect the Usage-Based Insurance Market trends?

- What sustainability trends are impacting the Usage-Based Insurance Market?

- Does the report include a SWOT analysis of key players in the Usage-Based Insurance Market?

- How frequently is the Usage-Based Insurance Market report updated?

- Can the Usage-Based Insurance Market report be customized for specific business needs?

- What are the future opportunities and challenges identified in the Usage-Based Insurance Market?

Browse More Reports:

https://www.databridgemarketresearch.com/pt/reports/global-aerospace-lubricant-market

https://www.databridgemarketresearch.com/pt/reports/asia-pacific-customized-premixes-market

https://www.databridgemarketresearch.com/jp/reports/asia-pacific-snack-pellets-market

https://www.databridgemarketresearch.com/jp/reports/south-africa-safety-shoes-market

https://www.databridgemarketresearch.com/de/reports/europe-glioblastoma-multiforme-treatment-market

https://www.databridgemarketresearch.com/zh/reports/asia-pacific-airless-dispenser-market

https://www.databridgemarketresearch.com/pt/reports/europe-horticulture-lighting-market

https://www.databridgemarketresearch.com/fr/reports/asia-pacific-polystyrene-packaging-market

https://www.databridgemarketresearch.com/jp/reports/global-ocr-passport-reader-market

https://www.databridgemarketresearch.com/pt/reports/asia-pacific-cannabidiol-market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

Tag

Usage-Based Insurance Market Size, Usage-Based Insurance Market Share, Usage-Based Insurance Market Trend, Usage-Based Insurance Market Analysis, Usage-Based Insurance Market Report, Usage-Based Insurance Market Growth, Latest Developments in Usage-Based Insurance Market, Usage-Based Insurance Market Industry Analysis, Usage-Based Insurance Market Key Player, Usage-Based Insurance Market Demand Analysis"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness