GCC Foodservice Market: Key Drivers, Regional Insights & Forecast to 2033

GCC Foodservice Market: Trends & Summary (2025–2033)

Market Overview

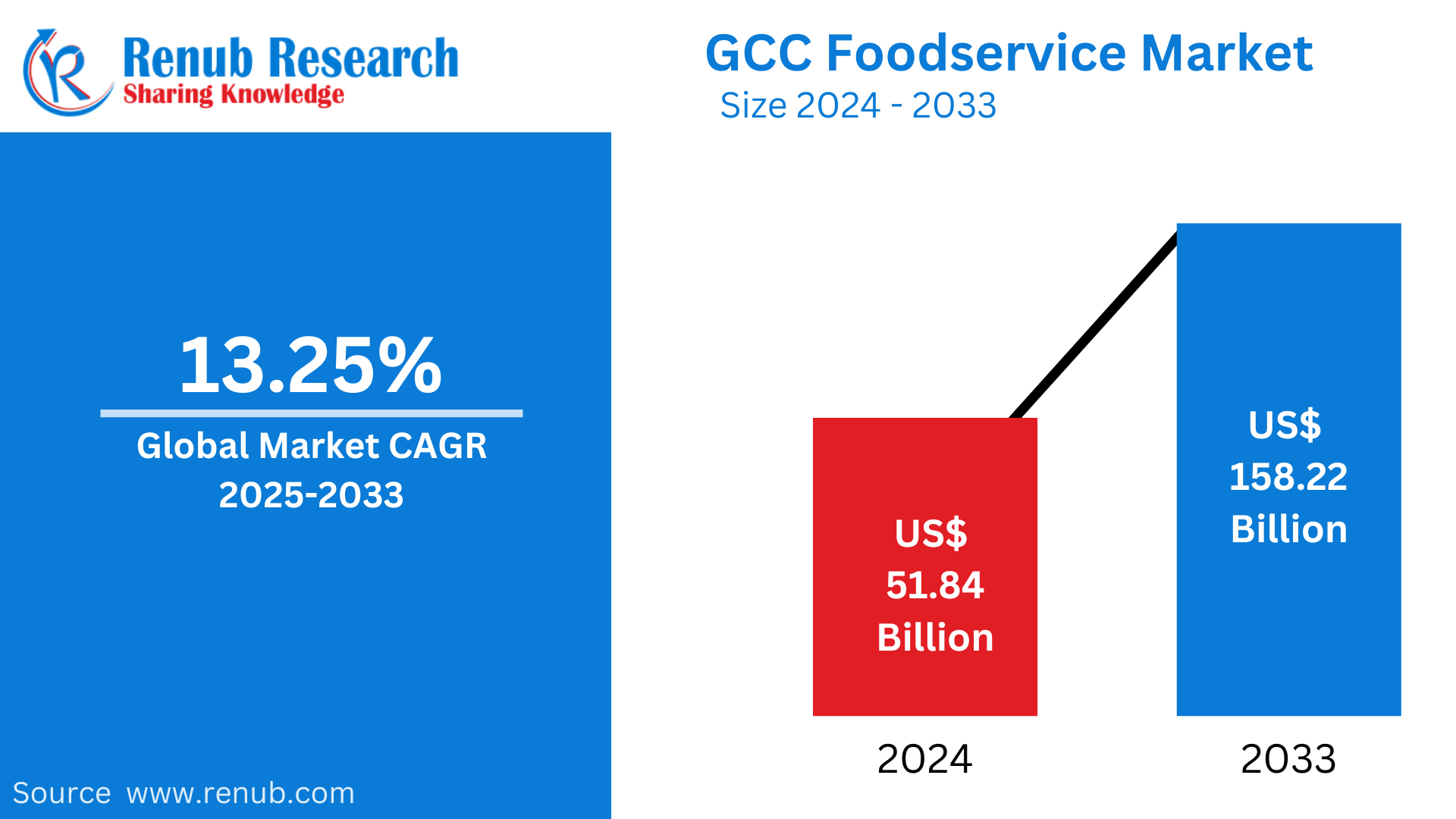

The GCC foodservice market is forecasted to surge from US$ 51.84 billion in 2024 to US$ 158.22 billion by 2033, growing at a CAGR of 13.25% during 2025–2033. This remarkable growth is fueled by rising tourism, rapid urbanization, evolving consumer preferences for convenience and health, and strong technological adoption in the food ecosystem.

Key Growth Drivers

1. Urbanization and Demographic Shifts

The expanding urban population across GCC countries is driving demand for diverse foodservice formats—from quick-service outlets to premium dining. The region’s youthful population and influx of expatriates support a multicultural dining landscape.

2. Rising Disposable Incomes

With growing household incomes, consumers are willing to spend more on food experiences—from premium international cuisines to health-conscious and convenience-based options like food delivery and grab-and-go meals.

3. Booming Tourism

Mega-events like Expo 2020 Dubai, FIFA World Cup 2022, and global sports tournaments have boosted tourism, in turn increasing demand for varied and premium foodservice offerings in hubs like UAE, Saudi Arabia, and Qatar.

4. Tech-Driven Transformation

Digital innovation—cloud kitchens, mobile ordering apps, AI-driven delivery logistics—is reshaping how food is accessed and consumed, creating new business models and improving customer engagement.

5. Health and Sustainability Trends

Consumers are increasingly favoring organic, locally sourced, and sustainable menu items. Operators that embrace eco-conscious practices and transparency are gaining customer trust and loyalty.

Market Challenges

⚠️ Sustainability and Food Waste

Operators face mounting pressure to adopt eco-friendly operations, manage food waste, and reduce single-use plastics. However, high costs and lack of infrastructure pose barriers to sustainable transformation.

⚠️ Volatile Food Prices

GCC’s heavy reliance on food imports exposes the region to fluctuating international prices, geopolitical risks, and global supply chain disruptions. These factors can impact profitability and menu pricing strategies.

New Publish Reports

· GCC Augmented Reality Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

· GCC Liquid Biopsy Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

· GCC Foodservice Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

· GCC Hydroponics Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Key Market Segments

🔹 By Foodservice Type

- Cafes & Bars (Specialist coffee shops, Juice & Dessert Bars)

- Cloud Kitchens

- Full-Service Restaurants (Asian, European, Middle Eastern, Latin American, North American)

- Quick-Service Restaurants (QSRs) (Pizza, Burger, Bakeries, Ice Cream, Meat-based cuisines)

🔹 By Outlet

- Chained Outlets

- Independent Outlets

🔹 By Location

- Retail

- Leisure

- Standalone

- Lodging

- Travel

🔹 By Country

- United Arab Emirates

- Saudi Arabia

- Qatar

- Kuwait

- Bahrain

- Oman

- Rest of GCC

Country-Level Insights

🇦🇪 United Arab Emirates

A diverse and wealthy expat population, along with booming tourism in Dubai and Abu Dhabi, drives growth in cafes, fine dining, and fast casual. Over 6 million cups of coffee are consumed daily, with coffee sales exceeding US$ 630 million annually. The UAE is becoming a coffee capital and innovation hub in the GCC foodservice landscape.

🇸🇦 Saudi Arabia

Vision 2030’s economic diversification fuels growth in food chains and luxury dining. The youth-led population, rising affluence, and health-conscious preferences are reshaping foodservice menus with sustainable and tech-driven offerings.

🇧🇭 Bahrain

Despite being a smaller market, Bahrain boasts high foodservice penetration due to its affluent, cosmopolitan population. Growth is supported by business tourism, major events (e.g., Formula 1), and a strong preference for international and healthy cuisine options.

🇰🇼 Kuwait

Driven by a young, urban population, Kuwait’s foodservice growth is centered on QSRs, meal delivery apps, and international dining concepts. Consumers prioritize both convenience and healthier menu options, including low-calorie and organic foods.

Competitive Landscape: Key Companies

- Al Tazaj Fakeih

- Alamar Foods Company

- ALBAIK Food Systems

- Galadari Ice Cream Co. Ltd LLC

- Herfy Food Service Company

- Kudu Company

- LuLu Group International

- Riyadh International Catering Corp

- Shahia Food Ltd Company

These firms lead with strategies like menu localization, franchising expansion, delivery innovation, and eco-conscious operations.

GCC Foodservice Market Outlook

The GCC foodservice industry is poised for strong and sustained expansion due to:

- Diversified consumer tastes

- Rising health and lifestyle consciousness

- Tech-enabled convenience

- Government support for tourism and economic diversification

Fusion menus, coffee-centric cafés, and digital-first formats will define the next phase of competition and growth.

✅ Optimized On-Page Elements for SEO

- Title Tag (SEO): GCC Foodservice Market Size, Growth Trends, Forecast 2025–2033

- Meta Description: Explore the GCC foodservice market's growth to US$ 158.22 Billion by 2033. Analyze key drivers, country-wise trends, leading companies, and market segmentation.

- H1 Tag: GCC Foodservice Market: Trends, Forecast, and Competitive Landscape

- URL Suggestion: /gcc-foodservice-market-trends-growth-forecast

- Keywords to Target:

- GCC foodservice market

- foodservice trends GCC

- UAE restaurant market

- Saudi Arabia dining trends

- cloud kitchens GCC

- QSR market GCC

- café market UAE

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness