Lot Size Calculator’s Free Position Size Calculator: How It Works

In the competitive arena of forex trading, understanding how much capital to risk on each trade is essential for long-term success. Utilizing a position size calculator is a critical step in this process, particularly the free lot size calculator available to traders. This tool enables traders to determine the optimal position size based on their risk tolerance and specific trade parameters. This article explores how a lot size calculator works, its features, and its significance in enhancing trading strategies.

Understanding the Basics of Position Sizing

Position sizing refers to the number of units a trader buys or sells in a given trade, directly impacting potential profits or losses. In forex trading, position sizing is crucial for effective risk management. The goal is to ensure that losses remain manageable and do not threaten a trader's overall capital. For instance, if a trader has a total account balance of $10,000 and decides to risk 2% on a single trade, they must calculate the amount they can afford to lose. This foundational understanding sets the stage for using a position size calculator effectively.

Features of the Free Position Size Calculator

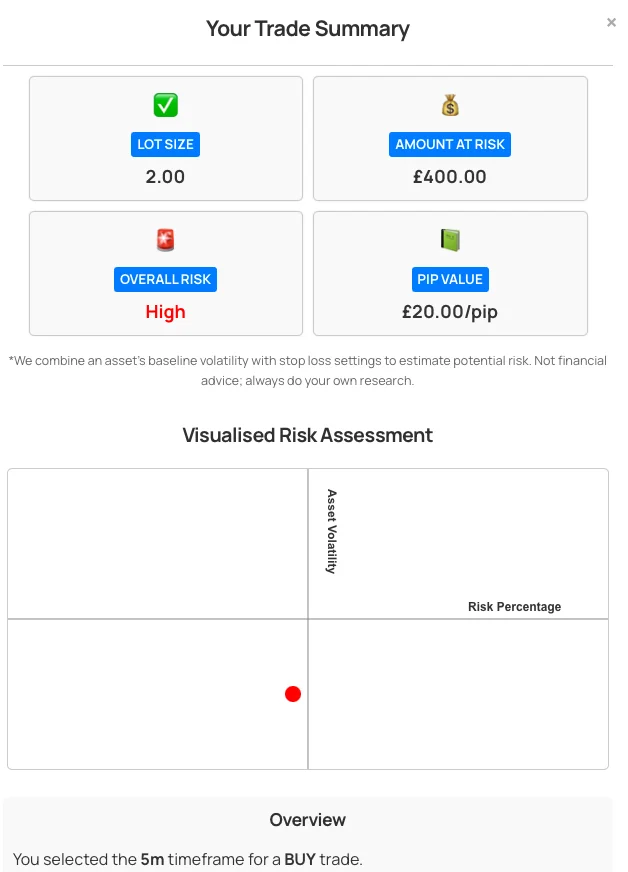

A free position size calculator is designed to simplify the calculation of appropriate lot sizes for every trade. Traders typically need to input several critical factors: their account balance, the percentage of risk they are willing to take, the currency pair being traded, and the distance to the stop-loss level measured in pips. The calculator uses these inputs to create a tailored position size recommendation. Most calculators are user-friendly and accessible online, ensuring that traders can quickly make calculations without complex formulas or extensive technical knowledge.

How to Use the Position Size Calculator

Using the free position size calculator is a straightforward process that empowers traders regardless of their skill level. First, begin by entering your account balance into the calculator. Next, specify the percentage of your trading account that you are comfortable risking on a single trade. This ensures that you are staying within your risk management guidelines. After inputting your stop-loss distance in pips, the calculator will provide an optimal position size that aligns with your risk tolerance and specified parameters. The ease of use makes it an indispensable tool for novice and experienced traders.

The Importance of Risk Management

Effective risk management is fundamental to achieving long-term success in forex trading, and a position size calculator plays a crucial role in this regard. By calculating the appropriate lot size for each trade, traders can protect their capital from significant losses that could arise from market volatility. Sticking to a predetermined risk percentage, such as 1% or 2% of the total account balance, ensures that even a string of losses does not devastate the account. By implementing a position size calculator, traders can develop disciplined trading habits, enhancing their ability to navigate the unpredictable nature of forex markets.

Benefits of Using a Free Calculator

The advantages of using a free position size calculator are manifold. First, it saves time, as traders no longer need to perform manual calculations that can be intricate and error-prone. Second, it helps maintain discipline by encouraging traders to adhere to their risk management strategies and avoid emotional decision-making. With the calculator providing instant feedback on position sizes, traders can make informed decisions quickly and efficiently. Lastly, these tools are typically accessible via various platforms, making them convenient to use on the go or directly within trading environments.

Handling Different Trading Styles

Position size calculators are adaptable tools that can cater to various trading styles. Whether a trader is a day trader focusing on short-term trades or a swing trader seeking to capitalize on larger movements over several days, the calculator can provide guidance tailored to each scenario. By allowing traders to adjust their inputs based on their style and strategies, a position size calculator effectively serves as a personalized risk management assistant. This adaptability encourages traders to explore different strategies while maintaining control over their risk exposure.

Building Confidence and Making Informed Decisions

For many traders, uncertainties can lead to hesitation and indecision during trades. Leveraging a position size calculator bolsters confidence by providing clear guidance on how much to risk on a given trade. The knowledge that the position size is aligned with predefined risk parameters allows traders to execute their strategies without second-guessing their decisions. As traders become more comfortable with their risk management practices, their overall approach to trading becomes more disciplined and calculated, setting the stage for greater success.

Conclusion: Empowering Forex Traders with Technology

In conclusion, the free position size calculator is an essential tool for any forex trader looking to enhance their risk management approach. By simplifying the process of calculating lot sizes based on crucial inputs, this calculator empowers traders to make informed decisions while adhering to their risk tolerance. Understanding its functionality and incorporating it into daily trading activities can lead to increased discipline, enhanced confidence, and ultimately improved trading performance. As technology continues to shape the future of trading, tools like the position size calculator will remain indispensable assets for traders navigating the complexities of the forex market.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness